Is property better than a pension?

We analyse the common strategies that investors use to buy property for retirement planning. Then we ask the question is property better than a pension?

We start this article by taking a look at the most common way of planning for retirement which is a pension. We analyse how effective it is for building up an income for retirement. Then we look at other considerations such as succession planning to assess how effective a pension is to achieve your financial objectives.

The next stage of our article will be to assess property as an alternative option for retirement planning. We will then compare and contrast some of the strategies used to acquire property to see how effective they are as a substitute for a pension.

At the end of this article, we hope that you have a clearer understanding of how pensions and property investment work. This is so you can understand the advantages and limitations of both methods as a way of planning for your retirement. However, due to the complexity of pension rules, this article can only cover the basics as the subject matter is too large.

The traditional approach

The old ways of retirement planning were quite simple. An employee would work for a company for most of their life and in retirement, the company would look after them. This was because most employers ran defined benefits schemes. A defined benefit scheme is commonly known as a final salary scheme where employees could expect to get two-thirds of their salary at retirement.

Unfortunately, these schemes have become very uncommon in the private sector. This is due to several reasons. The main one is the lack of funds in pension schemes to meet this obligation. Reasons cited as to why these types of schemes are no longer sustainable include a longer life expectancy, a lower inflation environment (maybe not in 2022), and the underperformance of equities.

How pensions work

Today most pension schemes in the private sector are defined contributions. This means you invest into your personal or company pension and its performance dictates how much money you build-up over time.

At retirement you can take up to 25% tax free in cash and the rest must be used to buy a compulsory annuity. The rate you receive from this annuity will determine your pension.

Recent rule changes to pensions mean investors now have more control over what they do in retirement. Buying an annuity is no longer compulsory. But choosing to liquidate your pension means you will be taxed as earned income, which could result in a hefty tax bill. An investor can also choose when to draw down funds if selecting an annuity.

There are other types of pensions such as SIPPs and SSAS. These schemes offer greater flexibility, but charges tend to be higher.

What is an annuity? And how to they work?

An annuity will provide you with an income for the rest of your living life. When selecting an annuity you have several options. You can opt for a guaranteed payout for several years irrespective of your mortality. You can opt for your pension to continue to pay your spouse after death, and you can choose to have the annuity rise each year to protect against the erosive effect of inflation.

When you choose to drawdown your annuity you will be offered a rate on the open market. This rate is determined by the factors mentioned above along with your projected life expectancy. The tables below show what you can expect.

Annuity Rates Table – Standard July 2022 (last updated) Table 1 below shows standard annuity rates for a pension fund of £100,000 after the tax-free lump sum of £33,333 has been taken from the full fund of £133,333 for a single life based on a Central London postcode. Whilst table 2 shows the rates for the same amount for a joint life with an identical postcode. It should be noted that smokers and investors with poor health may be offered increased rates, and so might people living in other parts of the country. |

| Single Standard Basis | |||

| Age | Level rate no guarantee | Level rate + 10-year guarantee | 3% escalation no guarantee |

| 55 | £4,616 | £4,580 | £2,719 |

| 60 | £5,081 | £5,026 | £3,203 |

| 65 | £5,893 | £5,767 | £4,021 |

| 70 | £6,664 | £6,458 | £4,831 |

| 75 | £8,038 | £7,603 | £6,090 |

| Age | Level rate + 50% Joint Life | Level rate + 100% Joint Life | 3% escalation + 50% Joint Life |

| 55 | £4,289 | £4,083 | £2,547 |

| 60 | £4,656 | £4,419 | £2,939 |

| 65 | £5,452 | £4,976 | £3,623 |

| 70 | £6,283 | £5,665 | £4,407 |

| 75 | £7,317 | £6,506 | £5,429 |

As you can see the longer you wait before you decide to drawdown results in an increased rate. Whilst protecting against inflation, getting a guaranteed number of years’ payment or offering funds to your partner if they outlive you, will reduce your payment.

Advantages of a pension

A pension is the government’s preferred way of getting people to provide for their retirement. In recent years and they have made auto-enrolment compulsory for many employees. As the government wants people to plan for retirement, (to ease the burden on the state) they have introduced a number of incentives. Below we list the key advantages of this financial product.

- Your employer is expected to contribute. Since April 2019 your employers are expected to pay a minimum of 3% of your gross salary. Whilst you pay a minimum of 5% of your salary.

- Your employer may match your contributions. This means the more you pay into your pension the more your employer does. This effectively gives you an indirect pay rise.

- You can get a tax credit for extra money you pay into a pension. For higher rate earners this means for every pound of extra income that goes into a pension they will receive 40 pence back from tax. The net result is that an earner in this bracket is up by 66.67% from day one.

- Tax-free lump sum. With pensions, you have an option of taking out 25% tax-free from your pension. This is something you should take advantage of. This is because an annuity is taxable income meaning you are likely to be taxed at either 20 or 40 per cent depending on your income. You can find out about the current tax rates via our tax card.

- The power of compounding. The earlier you start the more your pension will build up over time. By starting earlier you will build up considerably more compared to investing later.

- You could opt for a staged drawdown or a combination of drawdown and annuity. The enclosed link explains this in greater detail. The key benefit of this approach is you can take the same income as an annuity but you are likely going to leave a surplus in your pot which could leave a legacy for your children.

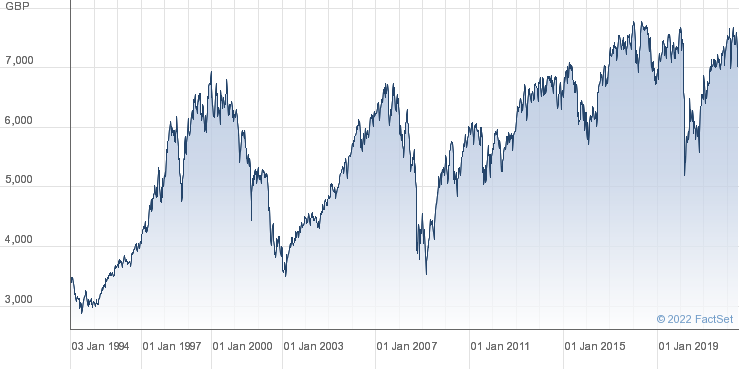

- Volatility can be your friend. The volatility of the stock market can allow you to buy more shares for your money at times when the market is not going well. Below you can see a chart of the FTSE100 from 1995 until the present day. At times the market has fallen by 50% from previous highs. In such an instance you can buy twice the amount of shares for your money with your monthly contribution to your pension fund. This volatility is an advantage in the early years of investing.

Disadvantages of a pension

- Potential shortfall. The annuity is dependent on the performance of the fund. This has several disadvantages. If the fund doesn’t perform then you may not have sufficient income in retirement. For many, this is a concern and since the turn of the century the FTSE100 has moved sideways whilst property has appreciated significantly. Though in fairness smaller and mid-cap funds have performed better with the FTSE250 up by almost 200% in the same timeframe.

- Volatility. The volatility of equities means you are unable to know what the value of your fund is at retirement. This means that you have to either move funds into other asset classes closer to retirement to hedge against a downturn in the markets or alternatively you could be forced to wait until the market has rebounded before you choose to take your annuity. The freedom to use staged withdrawal though provides some flexibility if you find yourself in this situation.

- Fees. When investing in a personal pension you are going to have to pay fees. Typically this is 1-2% of your contributions. Though, according to Money Helper (a government approved scheme), “if you’re in a workplace or a stakeholder pension, there’s a charge cap on the default pension investment available if you don’t choose. This is set at 0.75% of the investment. In other words, for every £100 invested, you would be charged no more than 75p.”

- Complexity. As many people don’t fully understand how pensions work they often make the wrong choices. This is why we recommend that you speak with a suitably qualified investment professional.

- No leverage. Unlike property, pension funds don’t use mortgages. The use of mortgage finance can magnify your returns over the longer term.

How property works

When buying property for investment purposes you are typically buying a buy-to-let property. You must pay stamp duty and this is taxed at a different rates compared to residential property. There is now a surcharge of 3% for this type of investment.

In addition to stamp duty, there are other fees. These include solicitor fees and the cost of mortgage finance if used. There are other ongoing costs such as maintenance, replacing boilers, and making sure your property is up to date on all the latest regulations. If you use an estate agent to manage the day-to-day running of your property then there is a cost for their services as well.

Income is dependent on having paying tenants and there can be void periods too.

Depending on your tax situation you will need to decide whether to buy property via a limited company or to keep it in your name. We suggest reading our guide on buying property through a limited company. This guide can be accessed in our investment hub.

Advantages of property

- Mortgage finance. You can use mortgage finance to purchase your investment property. This can magnify your property gains. For buy-to-let property, mortgages can typically fund 75 per cent of the property cost.

- Self-financing portfolio. As a property increases in value, you can release equity to help fund additional purchases. This approach has created many property millionaires.

- Rental income. When selecting a property in high yielding areas rental income is likely to be higher than dividends for equity funds. This in effect increases your real return. If you are using a mortgage then the rental income is likely to be significantly higher than the cost of servicing your mortgage.

- Emerging models. Property investors have found ways of generating extra income from property compared to the usual traditional model. One way has been converting your investment property into an HMO, or to do short term rentals. Both approaches can increase your rental yield.

- Flexibility. When investing in property you can choose to sell it at any time. This contrasts with a pension where your money is tied in until you reach 55. This number will rise to 57 in 2028.

- Legacy. Unlike a pension which usually stops paying out when you (and possibly your partner ) dies, the property can go to your estate and help provide for your children.

- Performance. In recent years property has outperformed equities. However, when taking a longer-term view (over 40 years) equities have delivered as well.

Disadvantages of property

- Fewer tax benefits. When investing in a pension you get a tax credit at the level you’re taxed. For investors in the 40% tax band they received 40p back for each pound they invest in their pension. With a property, this is not the case.

- Stamp duty. The recent changes to stamp duty rules mean that there is now a 3 per cent surcharge for typical buy-to-let property. This is in addition to the normal rates. This can make purchasing a property quite expensive. You can find out more about stamp duty in the appropriate guide in our investment hub.

- Mortgage interest rate relief. Changes to this rule mean that it is more expensive for higher rate earners to have a mortgage. One potential solution is to register property in a limited company. You can find out more about this by reading the appropriate guide.

- There are serval other charges to owning a buy-to-let property. These include professional fees such as a solicitor and maybe an accountant if choose to buy through a limited company. Then you have maintenance fees when things go wrong. There could also be regulation fees to ensure your property is up to date on all the legalities.

- Hassle. When buying a property you have to deal with conveyancing. Then when you own the property you need to manage letting and maintenance. Of course, this can be outsourced to an estate agent but this will eat into your bottom line.

- Void periods and problem tenants. When owning a property there will inevitably be periods where no money is coming in due to either no tenants or tenants who can’t or won’t pay. There are various insurances you can take out to mitigate against such a risk but these costs need to be factored in.

- Selling costs. With pensions, you can switch funds easily to take advantage of better performing markets. With property, larger transaction costs are making this strategy less beneficial.

Retirement planning strategies using property

There are several strategies that people use property to fund retirement. We take a look at the most common methods.

Using the 25% tax free lump sum to invest in property

An investor at retirement takes advantage of the tax-free lump sum that can be taken out of their pension and potentially tops this up with savings that they have gained from ISA investments. This approach is generally a good strategy as they can secure a high yield from the property without paying any tax penalties.

Investors using this approach usually opt for purpose-built student accommodation PBSA as it offers a high yield and bypasses the stamp duty surcharge as it is classified as commercial property. If your purchase is below £150,000 then there is no stamp duty to pay. For this type of investment, the yield is typically 7%. The advantage of this type of investment strategy is your income will rise with inflation and you have an asset that will form part of your estate.

In contrast, a joint-life annuity for a 65 year old person only yields 3.62%. Then when you both pass away there is no asset to pass down.

Liquidating your whole pension and buying a property.

This method is unlikely to be a good strategy as you will be taxed heavily for doing so. This is because you will be taxed as earned income and lose a lot of the capital value of your pension pot.

Investing in property instead of a pension

This strategy is not wise if you are closer to retirement. With a pension you get major tax breaks so just keeping money in a money based fund will deliver a good return due to tax rebates. This is especially the case for higher earners as every 60 pence invested results in one pound in the pension fund.

However, for investors with a lump sum to invest, with many years until they reach retirement then property could be a better solution. This is despite the extra fees incurred for buying property. The reason for this is simple, a mortgage will allow you to have more invested in property than you could put in a pension fund. This then over the longer term will allow your investment to grow at a faster rate. If you then refinance to buy additional properties then the potential returns could be higher still.

Expert Advice

Many people perceive property to be a better investment than a pension but when the numbers are crunched often this isn’t the case.

Depending on your situation it may be wise to invest in both property and pensions for retirement as this offers the benefit of diversification.

At Esper Wealth we recommend that investors looking at retirement planning should consult with an authorised investment professional. They will listen to your specific needs and assess your existing pension provisions.

Current benefits

The first stage of a pension review will be to assess your current entitlements.

Currently, the full new State Pension is £185.15 per week, providing you have 35 years of qualifying National Insurance contributions. For men born before 6 April 1951, or women born before 6 April 1953, your basic state pension is less.

Shortfall analysis

When planning for retirement your financial advisor typically will ask you how much income you need for retirement. Once they have a clear understanding of your income needs at retirement combined with your preferred age of retirement they can undertake a shortfall analysis.

A shortfall analysis calculates how much money you will need to generate your desired income at retirement. They will take into consideration your likely state pension and will assume a rate of growth for your existing pot. A financial advisor will assume an annual growth rate of 5-7% and add existing ongoing contributions to calculate your projected pot at retirement.

Then from current annuity rates, they will identify any shortfall you have and suggest the best options for your specific situation.