What is the most typical investment property? And is it best for me?

Investment property explained. We take a look at the most common investment property and evaluate how effective it is compared to other types of property investment.

Market Overview

Property investment is big business. New research from Octane Capital has indicated that there are record levels of privately owned rentals in the UK, with the number currently standing around 8.7 million homes. To put this number into context, the UK ranks fourth in the world for the size of its private rental market. Leading the way are the US, Germany and Japan.

This increased investment in property by private investors’ have helped drive up the price of property prices in the UK. This, combined with a housing shortage, has seen UK properties reach record highs. Currently, there is no let-up in sight. The property market is anticipated to rise for many years to come. Although at a more conservative rate.

Octane estimates that the UK buy-to-let market has a value of £1.7 trillion. This is an increase of £239 billion in the past five years. Many existing buy-to-let investors are looking at increasing their holdings further still. We consider the range of options available to property investors and see whether the traditional way of investing in buy-to-let is still the best option for their investment needs.

Investment Options

There are many ways you can invest in property. You can invest in off-plan developments, commercial property, as well as, purpose built student accommodation. You can also invest via equities and funds, as well as property bonds and REITs, or even through your pension.

However, most people when investing in property, prefer a buy-to-let investment. The vast majority of property investments involve buying existing properties on the open market.

The advantages of a typical investment property

Let’s start by taking a look at the advantages of a traditional buy-to-let compared to new build property. Though new build property is also a form of a buy-to-let property when bought for investment purposes.

- Transparency. Many investors like simplicity. If they feel they understand something it gives them confidence. As most people know what the average value of a flat or house is in their local area, they know if they are paying the right price. As this property type is very common, they can make many like for like comparisons on property on portals such as Rightmove. This is advantageous when investing in a less familiar area.

- Understand the process. Buying property involves dealing with solicitors and going through an exchange of contracts and completion. This can be quite intimidating the first time around. However, as you have already bought a familiar type of property for your own home, the purchasing process should be quite familiar to you.

- More Space. Older property tends to be slightly larger in comparison to newer built properties.

- Fewer charges. Typically, older style properties have less amenities attached to them. This results in lower management fees.

- No new build premium. When you buy a brand new property, you pay a premium as this property has never been lived in. With a normal investment property, this isn’t the case.

Disadvantages of a traditional buy-to-let compared to new builds

- Not up to regulation. The government has cracked down on landlords in recent years. There is a lot of new legislation to ensure that tenants’ accommodation meets minimum standards. This means most older properties will need to address a number of issues to be compliant with this new regulation.

- Not ready to be tenanted. It is likely that if you are buying an existing property you need to do some restorative work to make the property desirable to prospective tenants. This could involve putting in new kitchens and bathrooms in addition to the basics of painting and carpeting. These costs can eat into your bottom line.

- Outdated living. Many properties are not in line with what modern tenants require. This can impact rental yields as well as the type of tenant you are likely to attract.

- Energy efficiency rating. Older properties tend not to be well insulated. This costs the tenant more in bills which they could have spent on extra rent to you. Extra legislation is in place for buy-to-lets. Currently, these types of properties need a minimum energy efficiency rating of E but this is likely to be raised to C in a few years.

- No warranties. New build warranties give 10 years of protection for their owners. They come in two parts. A two-year defects insurance and a ten-year structural guarantee. This means owners of new build property are less likely to have to spend as much on maintenance costs.

Off-plan property

Off-plan property is very similar to new build property, except that it is not completed. This type of property is either being built or is still in the design and planning stage. The main benefit of off-plan is you can get a substantially discounted price. But the project does incur more risk. You can find out more information in an article titled off-plan property is it for me?

Taxation changes

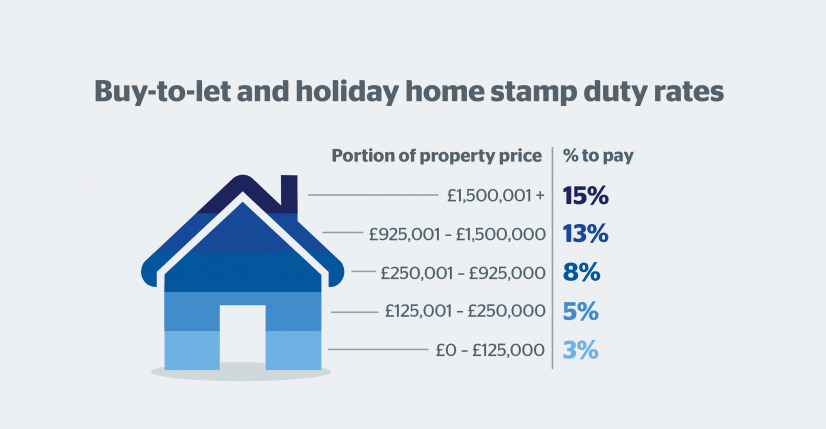

In response to a heating property market, the government has introduced a number of tax initiatives to deter some would-be property investors. One initiative was to introduce a 3% stamp duty surcharge on any additional property bought. The other initiative was to change the way mortgage interest relief was calculated. In our article buy-to-let mortgages the key details explained details how both initiatives impact the investor and is well worth a read.

Due to these initiatives, some property investors are looking at alternative ways of investing in buy-to-let property. Many landlords are now investing through limited companies due to the favourable tax structure. Yet some investors are looking at other areas of property altogether.

Student pods and commercial property

Purpose Built Student Accommodation (PBSA) is a growing area of the market. Many investors see this as a good alternative to a traditional buy-to-let. There are many advantages of investing in PRBA including a large reduction in stamp duty. However, it is difficult to obtain mortgage finance for this property type, so it isn’t for everyone.

Commercial property does not have the stamp duty surcharge either. Like PBSA the yield tends to be quite high. However, there are limitations. Lending is more restricted and a lot of commercial property has long void periods.

Funds, equities and bonds

Many investors prefer to avoid buying a property directly and seek to gain exposure to the UK property market in other ways. Most investment platforms allow investors to buy shares directly, or through funds. The main benefits include a lower entry-level and increased liquidity. There is also less hassle involved, with no worrying about mortgages, solicitors and tenants.

Unfortunately, there are disadvantages too. There is a form of double taxation, as the company or fund is subject to corporation tax and then you pay taxes on your earnings as well. The one exception is REITs which have several tax advantages. You can find out more about them in the appropriate section of our site. The other disadvantage is you don’t own the physical asset. This means you are entrusting a fund manager with your wealth, if they perform badly you haven’t got the property to fall back on.

Crowdfunding and tokens

Crowdfunding allows for fractional ownership of property. Through this medium you can invest directly in the physical asset but a far lower entry level. Crowdfunding is a rapidly growing market.

Tokenized real estate is the next big thing. Tokens allow for very small fractional ownership of property. Tokens will massively improve the liquidity of real estate. At Esper Wealth we have a partnership with the UK’s first ever property development company that is seed funded through blockchain technology.

Should I invest in a traditional investment property?

This depends on your investment objectives. If you are looking exclusively for income then there are better options available. If you want growth and income then this investment could be for you.

Buy-to-let investments have proven to be an excellent investment choice for a lot of investors. This market has performed exceptionally well over the last decade. Moving forward, the UK buy-to-let market still offers opportunities, but investors will need to be more selective to achieve the same great results.

A smart strategy is to focus on northern cities which offer high yield coupled with good growth prospects. It is wise to do research and identify areas where there are considerable regeneration initiatives as this will likely outperform normal areas.

At Esper Wealth we take a consultative approach to investment by giving you advice that is tailor-made to your specific needs. Contact us today for a free investment review. Or alternatively, you can check out a number of our investments on our developments page.