The effects of blockchain technology on real estate

In this article, we look at the participants involved when buying or selling real estate. We then analyse how the emergence of blockchain technology is set to change the way real estate is bought and sold.

Anyone who has bought or sold a house will testify that it is a long stressful process. Not only are you dealing with the other party on the other side of the transaction, there are several middlemen involved. This list includes solicitors, estate agents, lenders, as well as surveyors, insurance brokers, and even the EPC (Energy Performance Certificate) assessors involved in the process.

Middlemen

These middlemen are crucial participants. In this section, we take a brief look at their function in the conveyancing process.

Estate agents

Estate agents don’t just sell the property they act as a trusted middleman between the buyer and seller. The estate agent is well-versed in the rules and regulations for real estate transactions. So,

they can verify that the seller is the legal owner and that the buyer has sufficient funds to buy the property. But these agents don’t work for free. Typically they charge 1-2% of the sale price.

Solicitors

Solicitors have to perform various searches to ensure there are no nasty surprises. The basic searches they undertake are threefold:

- Local Authority Searches. This is in two parts. LC1 – Local Land Charge Register search. This includes any charges or restrictions related to land or property. This search is essential as registrations are legally binding on successive owners. The second part is called a CON29. A CON29 provides information on highways, new roads, railways, and any compulsory purchase orders.

- Environment Searches. This includes any potential flooding issues, landslide issues, contaminated land issues, and subsidence issues.

- Water and Drainage Searches. This entails finding out who owns and maintains the sewers, drains, and piping. Then find out if the property is connected to a public water supply and sewer. Whether the water supply is metered or rateable, and other searches to boot.

Historically information at the land registry has been antiquated with paper documentation. This historically creates extra demands for solicitors. As they are the ones with a legal responsibility to their respective clients, they are duty bound to ensure that their client is equipped with all the necessary information before the deal progresses to the exchange of contracts.

So with all this work solicitors do in the conveyancing process it is no wonder that their fees are high and the due diligence time is elongated too.

Lenders

Most property is purchased through the use of mortgages. The lender will agree to finance the loan subject to certain requirements. They essentially need to ensure that the borrower has the capacity to repay the loan and that the security against the loan is sufficient to pay them back should the borrower’s capacity to repay change.

This due diligence requires a lot of paperwork. They need to deal with anti-money laundering rules and regulations, analyse income statements, maybe even acquire references from the borrower’s employer. And this is the easy bit.

The lender also needs to ensure that the security is sufficient. This involves obtaining information on the search at the land registry. So a lot of paperwork is generated in their interaction with the other parties to gain all the necessary information to be happy to sign-off on the process.

Others

The surveyors, EPC assessors, and insurance brokers play their parts as well. Often they have to liaise with several parties which creates additional paperwork and time by having to send information to various parties.

Blockchain Technology

Blockchain technology has the potential to dramatically change how property is purchased. In an article titled, “Data, trust, and transparency in real estate – bringing it all together,” regional chairs of FIBREE Kevin O‘Grady & Jo Bronckers explain how blockchain technology can advance the house purchase process.

FIBRE stands for the Foundation for International Blockchain and Real Estate Expertise. It has been set up as the leading international network for exchanging knowledge between the real estate industry, the IT sector, and blockchain technology.

However, before we look at their findings, for those who are unfamiliar with blockchain we briefly explain what it is.

What is blockchain technology?

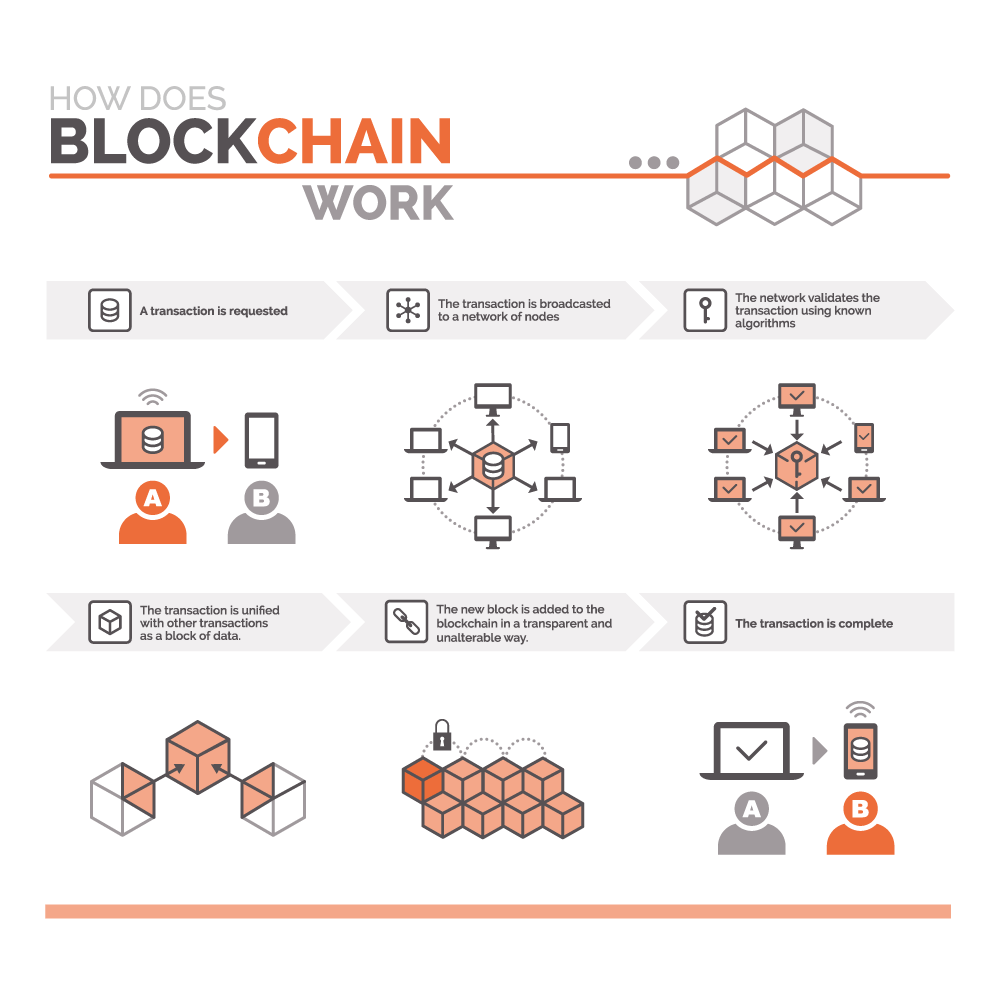

PWC explains “Blockchain is the technology that enables the existence of cryptocurrency (among other things).” in simple terms, “blockchain technology A blockchain is a decentralized ledger of all transactions across a peer-to-peer network. Using this technology, participants can confirm transactions without a need for a central clearing authority. Potential applications can include fund transfers, settling trades, voting, and many other issues.”

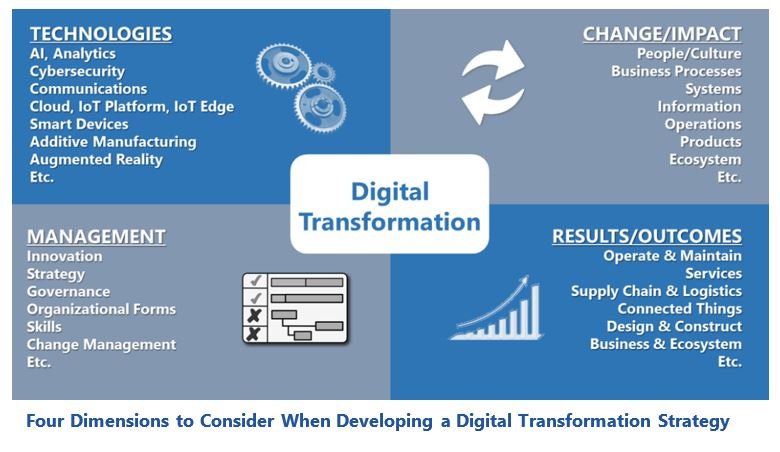

Digital Transformation

The UK HM Land Registry set out its vision for an “ambitious digital transformation towards becoming the world’s leading land registry for speed, simplicity and an open approach to data”. The objective is for “property to be changed instantaneously” and for the public database to hold more granular data through underlying blockchain protocols as a part of the “Digital Street” initiative.

Kevin O‘Grady & Jo Broncker explain that the online “Sign Your Mortgage Deed” system, is accessible to re-mortgaging homeowners via GOV.UK, is another recent development in the Land Registry / blockchain collaboration. Using the pre-existing GOV.UK Verify service for identity security and assurance, mortgage deeds can now be produced and signed as part of a largely disintermediated digital conveyance process legitimately recorded at the Land Registry.”

Thousands of mortgage deeds have already been signed this way, with major lenders including Nationwide, RBS and NatWest using this service. Conveyancers such as Optima LMS and Enact are also utilising this service.

So in the planning system blockchain offers much-needed efficiencies. For example, sequential principles can form standardised meta processes subsequently applicable to a range of key local planning authority decisions.

Regulation of this digital transformation

One slight obstacle is that legal structures will also need to adapt. “In the UK, beyond compliance with anti-money laundering regulations, today there are very few government regulations and laws surrounding the use of blockchain. Bodies such as the Law Society and the Financial Conduct Authority will have to ascertain how blockchain transactions are monitored.”

The FCA is adopting a “wait and see” approach, although has reportedly been communicating with regulators in other jurisdictions.

“Additionally, the development of property tokens in connection with blockchain technology provides a more affordable alternative when it comes to property investment, reducing the risk and expense involved at a time when businesses and incomes are already in a fragile position.”

Home Logbooks

“The immutable nature of using blockchains means that the accuracy and trustworthiness of the data eliminates the time needed for extensive due diligence and enables real estate to be immediately transferable. Storage of documents on a blockchain ledger – under the current system, parties are required to request title documents, relying on the fact that the necessary documents are recorded correctly and that there has been no mismanagement between transfers.”

By placing all real estate information in one place and recording this data in a structured manner, it would be possible to track and trace ownership interests of the data and be made available on a permissioned basis for the relevant parties to have access. This would rapidly speed up the process of collaboration between participants. With the net effect of saving time and money to obtain title reports between contract and completion.

O‘Grady and Broncker continue, “Sharing data from the Home Logbook with certified 3rd parties like valuators, municipalities, chartered surveyors, assessors, and more can have additional benefits because these 3rd parties can certify the available data with their specific expertise. An additional trust layer to data is created and the data will only become more appealing to the next custodian of the home.”

Network solutions needed

One of the existing problems of the real estate industry is the fragmentation of available data, often stored in various databases making the due diligence process very slow. As professional third party need to spend a lot of time to acquire the information the fees are paid by the prospective buyer are unnecessarily high.

However, once property information (such as title deeds, boundaries, etc) is successfully stored on the blockchain this information can be accessed quickly by solicitors without the need for expensive searches. Surveyors’ reports will already be on the blockchain from the previous property purchase so third party fees will be substantially reduced for future buyers. Having this information stored on the blockchain is beneficial to the home owner, as when any prospective buyer puts in an offer they know their fees are lower and they can get a positive answer more quickly. This is likely to result in either a higher selling price or a quicker sale.

Smart Contracts

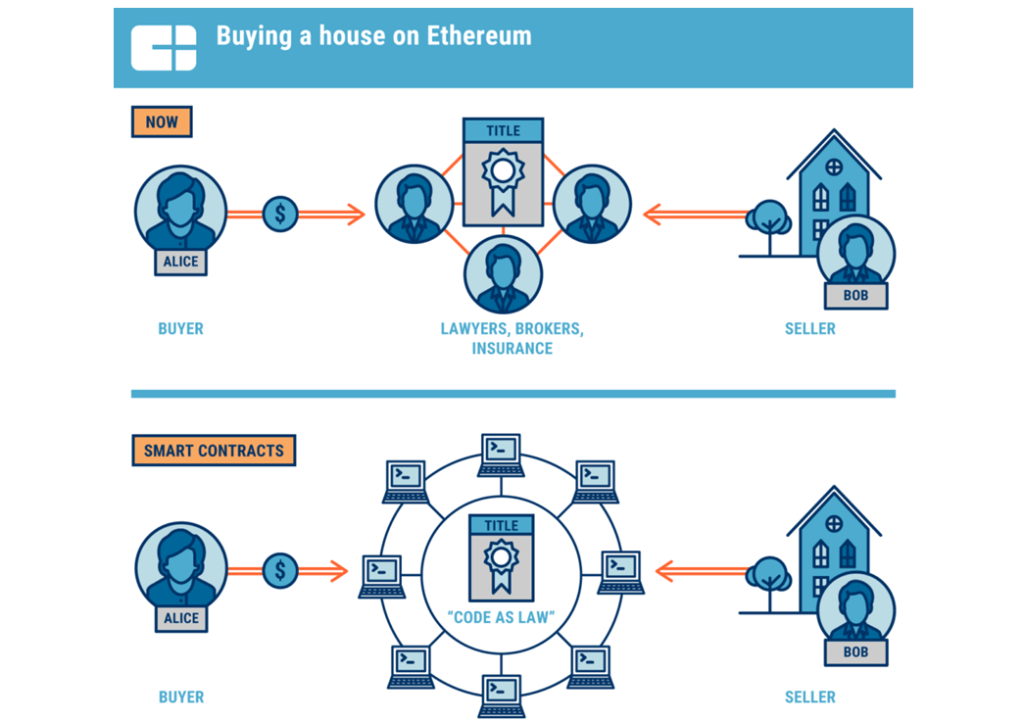

One of the most useful inventions that use Blockchain technology are smart contracts as these enable the automatic execution of transactions based on computer code, thus removing the need for human intervention. Since the real estate market deals with many transactions, it is an ideal use case for this technology.

Smart real estate contracts enabled by blockchain-powered platforms can help to make the due diligence process more efficient. It will speed up the process and lower the transaction costs of buying and selling a property. Blockchain technology can be used to authenticate identities. It can confirm ownership of the property, as well as highlight any planning, or restrictive covenants.

Smart contracts will also be able to define all the parameters of the deal from the outset. Forcing mortgage and loan provisions through smart contracts – mortgage contracts are filled with complex contingencies, covenants, and conditions that trigger different default events when they occur throughout the life of the loan. Upon the occurrence of a default event, the typical penalty is an increased interest rate until the breach is cured. Smart contracts can automate this process with greater accuracy than paper-based analogue systems.

Land Titles

The benefits of using blockchain with respect to land titles is huge. Paper documentation are vulnerable to loss, fraud, and mismanagement. Blockchain technology has none of these issues.

Blockchain technology can store this information across various companies which will eradicate the risk of fraud and the change of records in land entitlement.

As O‘Grady and Broncker explain, “The same goes for digital data about the property. Why not put all relevant data in a repository connected to an NFT and transfer the ownership of this NFT together with the legal property transfer at the notary so all relevant data remain with the property along its entire life cycle? Blockchain makes this in fact already today possible without a need for changing legislation first and this enhanced data-structuring may enable different significant process innovations throughout the entire real estate value chain.”

Financing

Historically, property financing and payments have been slow and expensive. This is due to extensive documentation and the participation of multiple intermediaries. “With all your key documents being stored in an open but controlled accessible database and referred to with hashes on a blockchain there will not be the need to send multiple different documents to your bank or estate agent.”

“It will be possible to access and verify credit checks, income, and identification verification, debt-to-income ratios, and much more by using Blockchain technology. Blockchains provide a system which increases and reinforces trust and reduces real estate broker dependency, meanwhile improving cost efficiency, accelerating transfers, and opening avenues for networking by creating a digital platform other entities can tap into.” (O’Grady and Bronker).

The pressing questions are who exactly should have access to this information? And if information is decentralised how will it impact GDPR?

Summary

There is no doubt that the effect of blockchain technology on real estate will be huge. In the long-term blockchain will radically change the way we buy and sell property. This is likely to be for the better. Transaction costs from middlemen are likely to be lower and their workload will fall. Most importantly the due diligence time will be shortened which will speed up transactions. Esper Wealth is creating PropTech in the form of smart contracts which will radically chain the way that property is bought in the UK by automating the process. This technology will save the buyer and seller considerable fees from all third parties. Consequently, we are targeting a franchise model as many real estate agents will want to adopt our processes.

At Esper Wealth we see the most immediate effects of blockchain technology on real estate is in tokenization. This will allow many users to buy fractionalised real estate swiftly. This topic was covered in our previous article the token revolution and its impact on real estate. This is why we have set up a joint venture with the world’s first developer that is funded exclusively through blockchain.