Security tokens are a rapidly growing market

There is a quiet revolution going on in the crypto market as the industry readies itself for new wave of credible investments in the form of security tokens. In this article we explain how the market is anticipated to evolve.

What are security tokens?

According to Investopedia, “a security token is a digital asset that represents ownership or other rights and transfers value from an asset or bundle of assets to a token. In plain language, security tokens are the digital form of traditional investments like stocks, bonds, or other securitized assets. For example, a company that wishes to raise funds for an expansionary project can decide to issue fractionalized ownership of their company through a digital token instead of issuing stock. It could then offer this token to investors on an exchange that allows digital security tokens.”

Whilst this may sound complicated the process in not new. Companies for example, used to give paper stock certificates to investors that purchased stocks. The paper certificate was in effect a token that represented ownership or other rights granted to the investor. A digital security token is no different, except it is digital and has gone through a blockchain tokenization process.

key takeaways

- All assets can be tokenized. For example, you can create a token that represents the ownership and registration of a car. The car’s vehicle identification number (VIN) could be tokenized along with the owner’s name, address, and other information required by a state to register a vehicle.

- A security token is classified as an investment. This means that people buy security tokens in the expectation of making money either in capital appreciation or through income.

What is the difference between a security token and a cryptocurrency?

A cryptocurrency and a token are practically the same. Both operate on the blockchain and use the algorithmic consensus which removes the need for a central validating authority.

The key difference is that a cryptocurrency has been set up to act as a substitute for fiat currency, whilst a security token has been set up to act as an investment. Bitcoin, for example, was set up as a substitute for fiat currency, though in reality, speculators have bought it to make a return. So in reality, it performs the same function as a security token.

As security tokens act like a collective investment scheme i.e. funds or securities, they often require regulation in certain jurisdictions. In the US the Securities and Exchange Commission must approve security tokens, whilst in the UK, this is the role of the Financial Conduct Authority. In contrast crypto which does not act as a security token is often exempt from regulation.

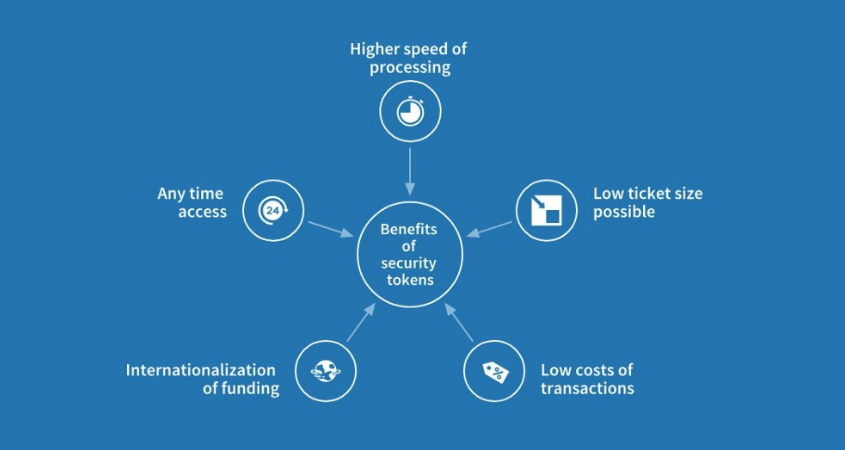

Benefits of security tokens

Many crypto tokens and coins offer nothing to the investor. Many are built of restricted supply that the developers hope will incentivise the market to retain value in its structure. Unfortunately, as many of these tokens/coins are unregulated they can be open to a large amount of manipulation. This is especially the case for some of the smallest offerings that are listed on offshore exchanges. Typically these tokens/coins have a large number of units but only a very small number are freely trading. This results in the price being manipulated as there is a reduced supply.

Regulated

In contrast, security tokens operate differently. As they are often regulated there is more transparency in how the token or coin is priced. Usually, the majority if not all of the tokens are listed so the price is a better indicator of market forces. This makes it more reliable as an investment.

Security

Perhaps most importantly, security tokens are underpinned by real-world assets. This could be commodities such as gold or silver. It could also represent assets such as real estate or land. Alternatively, security tokens could mirror equities and bonds, where their value relates to a real-world company.

Liquidity

Security tokens can bring extra liquidity to often illiquid assets. For example, large commercial real estate is a very illiquid asset. The only buyers are corporations, certain investment funds and the super-rich. Because of this, large commercial real estate often trades at a discount to its real market value. Furthermore, in times of a depressed market, its value can reduce at an exaggerated rate.

Looking at the Covid marketplace as an example, many investors decided to sell out of commercial property funds and REITs. As these funds hold the majority of investors’ funds in illiquid assets, when a substantial number of investors decided to sell, the underlying funds were forced to sell assets are a massively reduced rate to the detriment of remaining investors. This forced many REIT’s to stop investors from selling during 2020.

In contrast, security tokens are more liquid. Due to the structure they are not forced to sell assets. Simply the price of the token will rise and fall in line with the demand of market forces.

Furthermore, as token exchanges often have lower fees and are open 24 hours a day seven days a week, there is even greater liquidity.

Due diligence

Blockchain is immutable as all information is stored permanently. This offers several advantages. Firstly, as the information is stored and can’t be altered there is a lower chance of fraud. One of the other key advantages is the due diligence process. This is because information can be easily obtained through the blockchain, once a person is granted access. This makes the due diligence process quicker and cheaper as it reduces the time for investors or third-party validators to confirm information. This aids in transparency.

Regulated token exchanges and investor access

Whilst many security tokens are regulated some of the exchanges they are listed on aren’t. This is beginning to change.

Gibraltar

The Gibraltar Financial Services Commission, for example, has granted permission for Valereum to buy the Gibraltar Stock Exchange. Valereum is a blockchain company. It is expected that this will become a fully regulated token exchange. This is a big deal as it can be the catalyst to promote tokens to the mainstream.

Dubai, Hong Kong and Singapore

Dubai already holds significant legislation in crypto assets. This regulation which is overseen by the Dubai Financial Services Authority has recently been increased. It covers not only AML/CFT risks in respect of trading, clearing, holding or transferring Crypto Tokens but also addresses risks relating to consumer protection, market integrity, custody and financial resources for service providers.

Hong Kong is considering following suit. Hong Kong is looking at opening up crypto investments to retail investors. This goes against Chinese policy which bans this type of asset class for retail investors “We want to make our policy stance clear to the global market to demonstrate our determination to explore fintech with the global virtual asset community,” Financial Secretary Paul Chan told the Hong Kong Fintech Week conference.

Singapore like Dubai already offers regulation and access to Crypto investments. Crypto.com is based in Singapore due to the credibility of digit assets in that Jurisdiction. Recently the Monetary Authority of Singapore (MAS) published two consultation papers proposing regulatory measures to reduce the risk of consumer harm from cryptocurrency trading and to support the development of Stablecoins as a credible medium of exchange in the digital asset ecosystem. These measures will be part of the Payment Services Act. Stablecoins are pegged to an underlying currency. This makes them a viable substitute for currency.

United Kingdom

In the UK, several exchanges are registered with the FCA. However, currently investing in these crypto exchanges is excluded from its statutory protection. The biggest platforms registered with the UK regulator are eToro, Crypto.com, Coinbase, Uphold, CoinJar, Gemini, Coinsmart, OKX and Phemex.

Market size

Research from Stobox analytics shows that between April 2021 and April 2022, the security tokens market cap increased by 2650% and trading volume by 386%. Whilst the 12 months before saw the market increase by 500% and trading volume by 1000%.

Current trends

- 55 million cryptocurrency users ( approximately 7,5% of the European population)

- 40% of global cryptocurrency users come from Europe

- 25% of the global market capitalization in cryptocurrencies held by Europeans

- The security token market is still in its early days with major regulation upcoming

Future market

Research conducted by PlutoNeo and Tanguay shows that Europe is set to see a Security Token boom in the next five years. They anticipate a total market volume of more than €918 billion by 2026. This represents an annualised growth rate of 81% until 2026.

The market for digital assets in 2026

- The total market capitalization of digital assets will be 1,820 billion Euros

- Security token volume (50.39%) will be larger than cryptocurrencies (49.61%)

- Tokenized stocks will contribute 32.77% to the security tokens market

Real estate tokens

The vast majority of security tokens are in the real estate sector and this will continue. This makes sense as real estate is the largest storage of wealth, being larger than all the world’s equity markets and bond markets combined.

Furthermore, real estate has the most to gain from tokenisation as it offers to bring liquidity to a market that currently has large barriers to entry. This is why real estate tokens are considered by many to to be the next big thing.

At Esper Wealth we firmly believe that the crypto marketplace will be unrecognisable within 5 years. The market will evolve to become highly regulated, and dominated by security tokens.