Is the bubble about to burst on the UK property market?

Inflation is at a generational high and the Bank of England has raised interest rates again in an attempt to curb inflation. This has caused the cost of living to get tougher yet. With property trading at record multiples of people’s earnings, many people are concerned about a correction in the property market. So in this article, we ask the question is the bubble about to burst on the UK housing market?

Before we can answer this question we need to explain why inflation, interest rates and housing multiples are important considerations when assessing the housing market.

What is inflation?

Inflation is the rise in the cost of goods and services. In effect, it measures the reduction in the purchasing power of money. So if inflation is at 10%, this means you have to spend 10% more than 12 months ago to buy the same amount of goods and services.

Why is inflation important?

As the cost of goods and services rises, your income needs to rise alongside it. If your wages don’t increase as fast as inflation you become worst off. Even when wages rise in line with high inflation, tax exemptions and thresholds need to rise as well or you are indirectly affected.

Unfortunately for workers who earn the least, their wages have not risen in line with inflation. This has caused a cost of living crisis, with many people struggling to pay their monthly bills.

From a property perspective, less money to pay bills means that you may struggle to pay your mortgage. Alternatively, if you are planning to buy a property your affordability to buy a bigger property is reduced.

The protagonists of a property crash will identify this lack of affordability will result in a massive reduction in demand for property at these prices causing the housing market to retract.

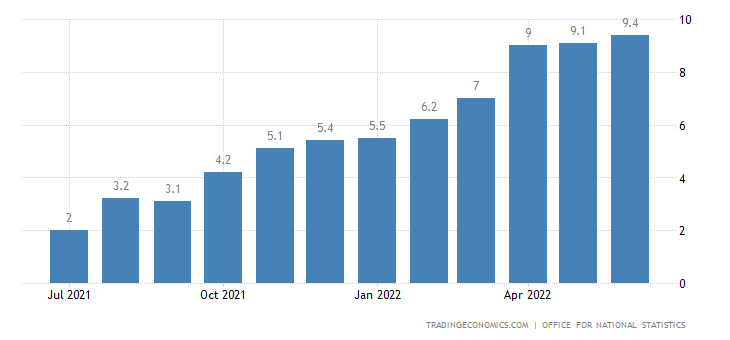

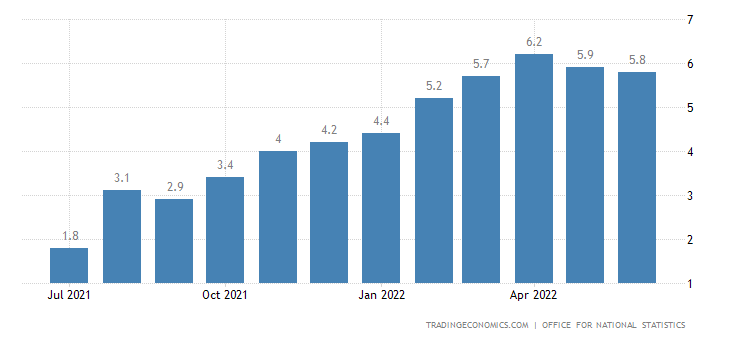

The chart below shows how inflation has increased to 9.4%. Inflation stood at 2% 12 months ago. Economists are now fearing inflation could rise to 13% by the end of the year.

How do you combat inflation?

According to economic theory, there are two ways to control the economy. This is by fiscal and monetary policy. In layman’s terms, fiscal policy is taxation. A government can decide to increase or decrease taxes. By raising taxes they can reduce inflation by restricting the amount of money that each person earns which results in them spending less and this reduces inflation as there is less demand for goods and services. However, this option is slow as it takes a lot of time for people to see the net effect of this strategy and spend less.

The most popular option is through monetary policy. This is about controlling the flow of money. Unlike fiscal policy, it is felt by people immediately so it can change people’s habits quicker. As a result, this is the preferred route to control inflation. There are various monetary tools that be used to fight inflation. The biggest one is to change interest rates.

What are interest rates?

One of the BoE’s main functions is to protect the economy from boom and bust. They address this function by controlling interest rates. Every month the Bank of England meets to decide on interest rates. They essentially have three options. They can increase rates, decrease rates or leave them unchanged.

Rising interest rates make the cost of borrowing higher. This discourages consumers to take out loans to buy new products as the cost of repayment is higher. Likewise, savers will be rewarded with higher interest rates. The net effect is that people will spend less and this should reduce inflation back to more manageable rates.

Why are interest rates important?

Rising interest rates also impact mortgage rates as this is also a loan. For mortgage borrowers, a rise in interest rates can have a dramatic impact on their mortgage costs. This is because many people have very large levels of borrowing.

For example, a person who is on a variable rate mortgage and has £200,000 of borrowing will typically see a rise of £2,000 per annum on the cost of their mortgage for every 1% rise in interest rates just to service the debt.

Currently, interest rates have risen by 1.65% this year. There are further rate rises expected on the horizon as the BoE strives to bring inflation down to its target of 2%.

If interest rates continue to rise mortgage affordability will fall dramatically. When combining rising rates with high inflation property owners have two major pulls on their income. This means many people will struggle to meet mortgage payments and could be forced to sell. The net result could be a fall in house prices.

House multiples

We are all aware that the property market has risen significantly over the past few years. However, most people are unaware of exactly how much. One way to understand this is to get an understanding of the cost of property against people’s earnings.

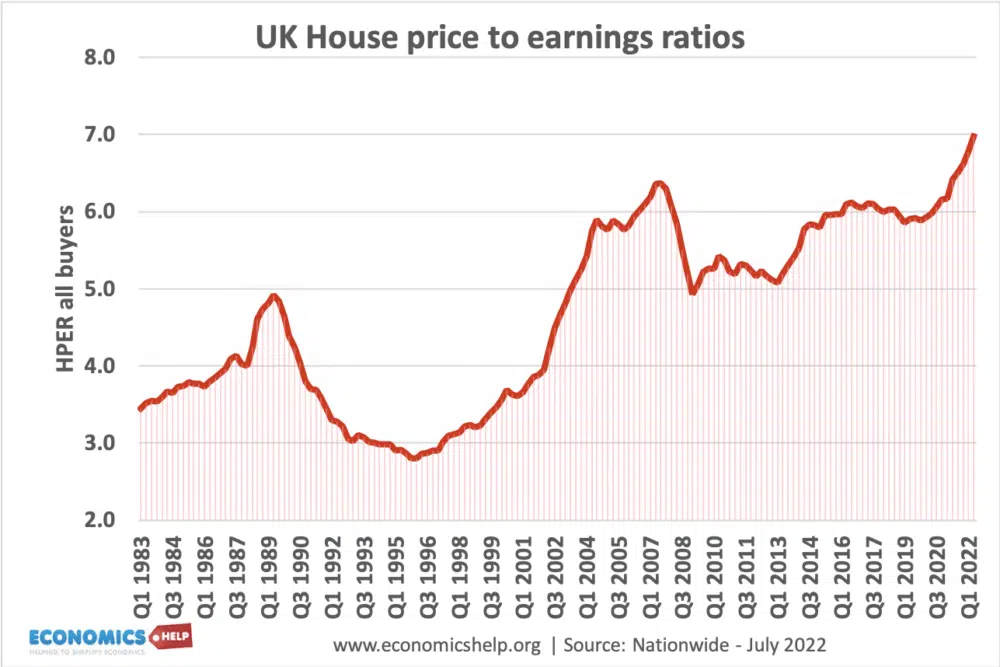

This statistic is best reflected by a chart showing the UK house-to-price earning ratios. The chart below does this, by showing how many multiples of the average salary an average house costs. As you can see average property cost is 7 times the average wage in 2022. Back in 1996, this figure was less than 3 times the average wage. This means a property costs over twice as much in real terms.

Why are house multiples important?

Most people buy a property through a mortgage. Often lenders restrict borrowing to a set multiple of your earnings. This figure is usually 3-4 times your earnings. This means that as property trades at ever-increasing multiples of income, younger generations can’t afford to get on the ladder as their income is not enough to secure a mortgage.

Buying property has been made even more difficult in recent years as the BoE has imposed more stringent lending criteria on mortgage companies. The rules meant that lenders had to assess a borrower’s ability to repay a mortgage if rates rose by 3%. This reduced people’s affordability to buy property.

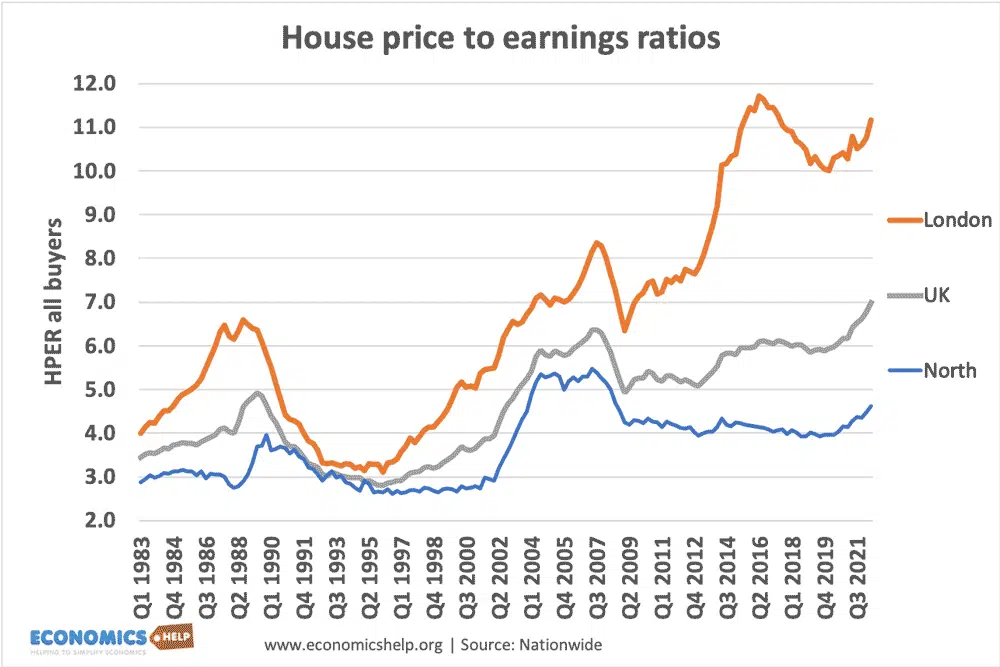

House price to earnings ratios is at record highs. When looking at the figures by regions these multiples become more pronounced. In London property operates at 11 times the average, whilst the north or England multiples are less than 5. Whilst wages are higher in London than the rest of the UK, they are nothing like the multiples of property suggests. Glassdoor says the average wage stands at £41,000 in London whilst the national average stands at £33,71

Some investors look at house multiples combined with inflation and rising interest rates and have serious concerns. They feel the bubble is about to burst on the UK property market as affordability for property is being stretched. This concern is accentuated by the BoE publicly stating that a recession is highly likely as it is forced to raise interest rates further. This is because as people spend less, there is less money circulating in the economy which results in fewer profits for companies. This in turn results in job losses, and this will impact the property market further still.

House price growth

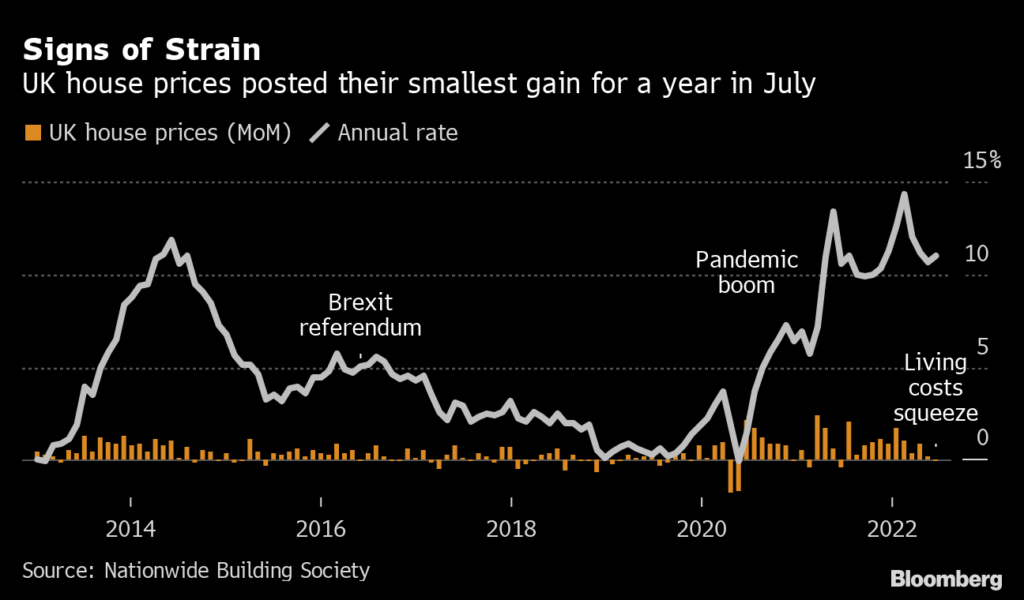

There are two sides to every argument and many investors have continued faith in the property market. Annual growth rates remain in double digits but growth has slowed. This is a far cry from asking if the bubble going to burst in the UK property market.

The chart below shows that despite rising inflation and the squeeze on disposable income the property market has remained resilient. Furthermore, most housing experts remain confident that property will deliver positive returns in 2022 and that prices are likely to show modest growth in the next few years.

Why do house builders and lenders remain positive?

There are several reasons why it is very unlikely that the UK property market will crash. This is despite inflation and rising interest rates.

Housing shortage

There still remains a dramatic shortage of homes in the UK. Supply and demand are usually the biggest determinants of prices. And quite simply put, the government has fallen short of its target to consistently build 300,000 new homes each year. Until there is more supply of homes then prices will remain high.

Inflation

Inflation has surged and this is a concern. Yet the figures don’t tell the complete story. The figures are heavily distorted by petrol prices and food costs due to Russia’s war on Ukraine and the international sanctions that have followed suit.

The annual core inflation rate in the United Kingdom which exclude prices for energy, food, alcohol and tobacco slowed for a second month to 5.8% in June of 2022 from 5.9% in May, matching market forecasts. This number is far more manageable.

Interest rates

Yes, interest rates have risen. But they remain incredibly low by long-term averages. The base rate was close to six per cent in 2007 and historically it has been a lot higher than that.

In the short term, interest rates may rise further still. Though they are very unlikely to reach the levels of 2007.

Furthermore, most mortgage owners are on fixed rate deals this has insulated many of them from the rising rates of interest. Interest rates will likely fall longer term when inflation levels return to their 2% target.

It is worth pointing out that interest rate rises caused the UK’s first ever property crash (along with high unemployment). This was in the late ’80s and early 90’s when interest rates rose from 10% up to 15%. This made many people experience negative equity, with lots of foreclosures.

Availability of mortgage finance

The previous property crash had been caused by a lack of mortgage finance. In 2007 the last crash was a result of the subprime lending bubble which resulted in banks being unable to lend money due to their very low solvency levels. This was commonly referred to as the credit crunch.

Currently, mortgage availability remains stable. Banks are far better capitalised and they will continue to be so due to minimum solvency requirements being imposed on them by the BoE.

Mortgage affordability

The Bank of England has recently removed the stress test for lenders. As of 1st, August 2022 lenders don’t have to test the affordability of borrowers if interest rates rise. This means there is more mortgage availability for borrowers. This comes at a time when the BoE is raising its rates. This should provide a stimulus for the housing market.

Our view

At Esper Wealth we certainly don’t believe that the bubble is about to burst on the UK property market any time soon. Quite simply the market still has strong demand and a lack of supply of homes. Interest rates remain very low by historic standards. We expect the property market to rise slowly for the next few years. Though growth rates will be higher in the North of England due to strong demand and prices trading at lot lower levels of price to earning ratios.

If you are a property investor who would like to know more about how to outperform the market we suggest speaking with one of our experienced investment consultants. Currently, we are offering all prospective investors a free investment review.

An investment review is a way for us get to know you and to better understand your specific financial situation and your attitude to risk. During an investment review, we will learn about your investment wants and needs. This way we can give you the best advice, to help you achieve your financial goals. If you are interested in this free service, then contact a member of our team who will be happy to help.