We cover all the essentials of capital gain tax so you know what to expect and what to do to minimise this tax obligation.

What is capital gains tax?

When you make money the government wants it’s cut. If you earn money you pay income tax, whilst if you invest in an asset and sell it for profit it could be subject to capital gains tax CGT. Though this is not always the case.

Exemptions

- If hold an investment for less than a year then sell it for a profit. In this instance, the government considers this as income so you would be subject to income tax.

- If you sell your principal property.

- If you use your CGT personal allowance. We discuss this in greater detail later.

- If you invest in something which is exempt from CGT.

What assets are subject to this tax?

There are too many to list.

- It can include the sale of shares, bonds, funds, or most other financial instruments, including cryptos.

- The sale of a business.

- Property investments, as well as inherited properties or second homes.

- Commodities such as gold, silver, and any other physical product.

- Other tangible assets, including art, wine, stamps, and classic cars.

How does capital gains tax work?

When you sell an asset for profit you may have CGT to pay. Unlike income tax, CGT is not automatically deducted by the inland revenue. You need to report this yourself.

You must report this correctly. Because if you don’t provide accurate reports, you will pay a hefty fine.

Capital gains tax allowance

Every person is entitled to a capital gains tax allowance. This is £12,300 for individuals. This means that you can make £12,300 of profit on your assets before the applicable rates kick in.

Should you have joint ownership of a taxable asset such as a second home, the allowance doubles to £24,600. For those who are married or in a civil partnership, assets can be exchanged between you.

However, be aware that if you do transfer assets to a partner and make a gain from this at a later date, the CGT that you pay will be based on the total time that you owned the asset(s) together, rather than the date of transference.

Capital gains tax rates

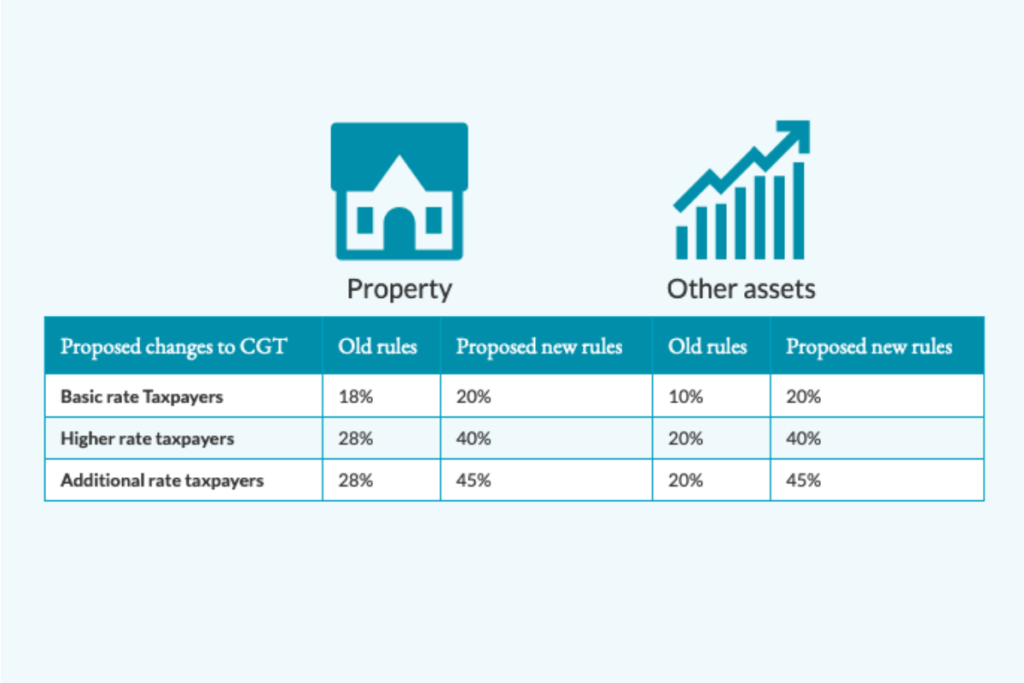

CGT rates differ from income tax rates and are in two broad brackets: basic rate payers and higher rate payers. Over the 2022/2023 tax year the basic rate on residential property gains was 18% and 10% on all other assets.

The higher/additional rate of CGT in the same year was 28% on residential property and 20% on all other assets.

However, there is no guarantee that these rates will remain the same in future years. The government has recently shelved plans to raise CGT. Though the FT has announced that this is more likely a stay of execution and could be introduced in the next parliament. The table below shows the proposed rate changes which were subsequently rejected.

How to calculate capital gains tax

You can do this manually. Alternatively, you can use a Capital Gains Tax Calculator on the government website. This page also lists out some of the deductions, and reliefs which may be available.

An accountant or a financial advisor will be able to analyse your income and outgoings and make sense of any tax obligations. You can find out about all other tax rates via our tax card.

How and when do I pay CGT?

If you currently complete a tax return, then CGT can be reported through this. Alternatively, you can use the UK government’s capital gains tax service to pay what you owe.

Anytime you sell a taxable asset and receive more for it than you paid, CGT will apply. CGT on second homes (or non-primary residential property) must be declared within 60 days of the completion of the sale.

If you’re including CGT within your annual tax return, the official deadline for tax returns is 31st January. However, for the sale of residential property de deadline is 60 days.

How to avoid capital gains tax

The simple answer is that if you owe CGT contributions then you must pay it.

However, there are several reliefs and conditions you can use which may mean the amount of CGT you pay is lower.

Ways to reduce capital gains tax

There are several things you can do to reduce your CGT bill.

- You can offset any losses against your gains.

- Transfer assets to your partner. This means that you both take advantage of your full pre-tax allowance of £12,300

- Use your CGT allowance. As CGT allowances can’t be rolled over into the following tax year you should use them whenever possible.

- Be aware of your wasted assets. Wasted assets are those which have a life of under 50 years, such as antique clocks, vintage cars, or caravans.

- Invest your money in SEIS, EIS, or ISAs. These investments provide tax-free benefits.

- Give to charity. If you give shares, land, or property to charity then income and CGT relief are available.

- Pay into a pension. This may alter your CGT bracket resulting in less tax.

- Where both spouses or civil partners have used their annual CGT allowance, ensure assets are sold by the individual who pays the lowest marginal rate of tax.

- Stay on top of your investments. By knowing what obligations you have you can work out how to minimise your CGT obligations by choosing the best time to dispose of an asset.

Implications for property investors

As a property investor, you are subject to CGT at a higher rate compared to other assets. Because of this, it is important to do what you can to minimise what you pay.

Fortunately there are a number of options available to you.

- You could invest in property via equities, funds, and REITs. These property-based investments are taxed at an 8% lower CGT rate compared to direct property purchases. They also offer the benefits of not having to deal directly with stamp duty nor solicitors and estate agents which also eat into your bottom line.

- If you are a couple and one person is on a lower rate then you can put the property in the lower rate person’s name.

- Think about buying property through a limited company. In terms of CGT, you are likely to pay 19%. Furthermore, your income tax will be lower if you are a higher-rate taxpayer.

At Esper Wealth we offer all prospective investors a free investment review. During your consultation, we will cover important tax issues to help you identify how best to structure any investment. If you are interested in leaving a legacy then we will cover inheritance tax to show you the best way of structuring investments.

If you feel that you would benefit from an investment review then contact us to arrange an appointment.